Addressing Critical Challenges For a Sustainable Future

In response to escalating global challenges like cost-of-living, education gaps and healthcare disparities, this strategy aims to leverage investments to drive positive change.

Responding to societal anxieties

Tackles the growing concerns of urbanization, inflation, and personal security, providing solutions that enhance affordability and stability in essential areas like housing, healthcare, and education.

Responding to societal anxieties

Tackles the growing concerns of urbanization, inflation, and personal security, providing solutions that enhance affordability and stability in essential areas like housing, healthcare, and education.

Mitigating the cost-of-living crisis

Addresses the sharp rise in living costs and the impact on low-income households, focusing on sustainable solutions to ease financial burdens

Promoting inclusive growth

Confronts shifting demographics and labor market changes by investing in diverse and inclusive education and workforce development.

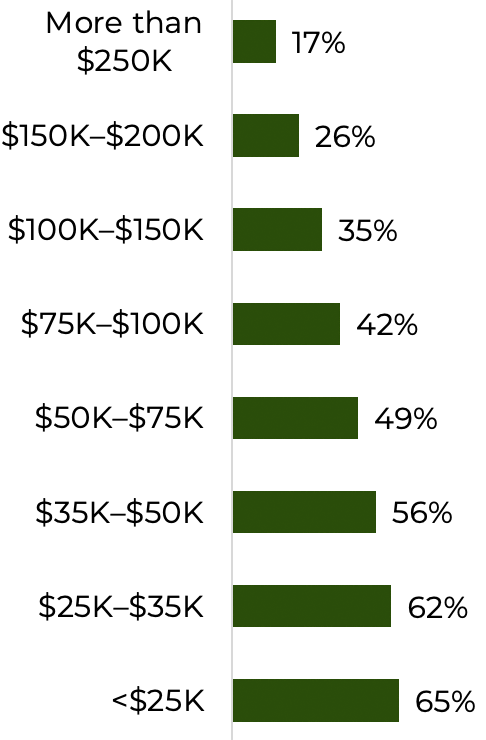

Level of stress caused by high inflation across income levels.

Source: World Economic Forum

Advancing Impact With Transparent Portfolio Structure

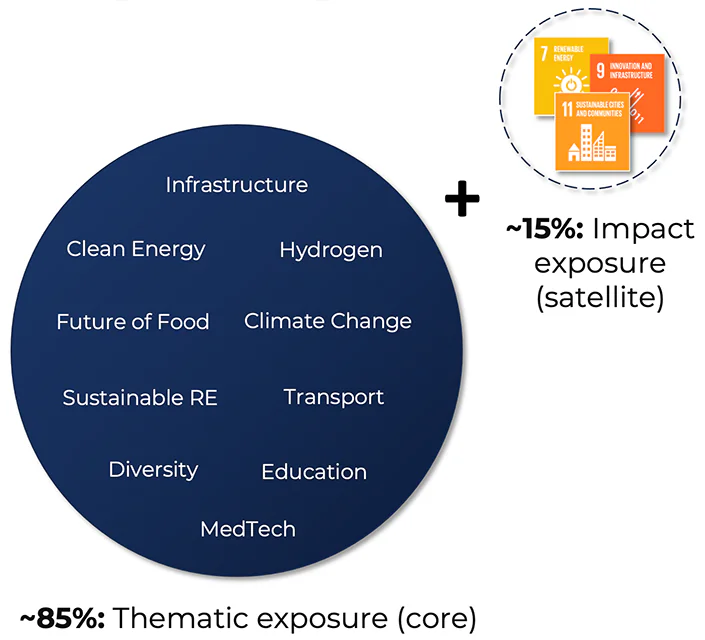

Integrating thematic and impact exposures to address global challenges

Responding to societal anxieties

Tackles the growing concerns of urbanization, inflation, and personal security, providing solutions that enhance affordability and stability in essential areas like housing, healthcare, and education.

Core: Thematic Component

Central to the strategy, focusing on industries such as Clean Energy, Transport, and Sustainable Real Estate.

Satellite: Impact Component

Expanding the core focus with a diverse array of investments in stocks aligned with SDGs 7 (promoting renewable energy), 9 (encouraging innovation), and 11 (fostering sustainable cities).

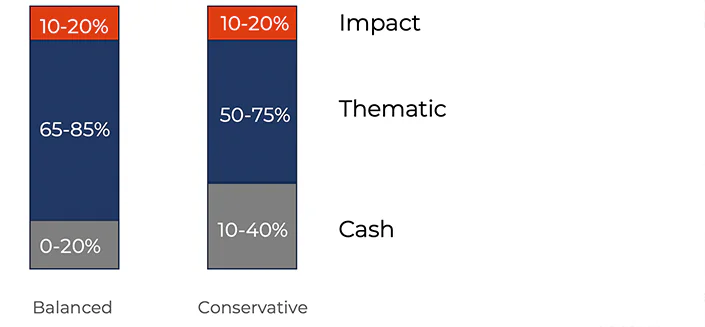

Balanced portfolio

Balancing core stability with clear and concrete satellite innovation enables a focused investment approach, driving steady growth and impactful outcomes.

Mapping Sustainable Development Goals to thematic impact exposure

3-Step Thorough Instrument Selection

1. Thematic & Sustainable Screening

To assess instruments that align with specific goals we apply two distinct filters:

- Thematic screening filter Identifies instruments in industries like Clean Energy, Transport, Sustainable Real Estate — essential for addressing global challenges.

- Impact screening filter Evaluate potential companies promoting affordable and clean energy (SDG 7), building resilient infrastructure (SDG 9), fostering innovation in sustainable cities (SDG 11).

2. Fundamental Analysis Score

The fundamental score is a composite rating that assesses a company’s financial health and growth potential based on the following categories. Each category is assigned a score based on its performance, and the aggregate of these scores provides the overall fundamental score for the company:

- Financial situation

- Valuation

- Growth assessment

- Financial health & risk

- Sentiment

3. Impact Score

The impact score evaluates how well the company aligns with the Sustainable Development Goals (SDGs) and contribute to positive societal outcomes.

- Quantitative - This involves measuring specific indicators related to social and environmental outcomes, such as: Healthcare Crude Coverage

- Qualitative - This encompasses evaluating policies and practices with significant impact, even if not easily quantified.

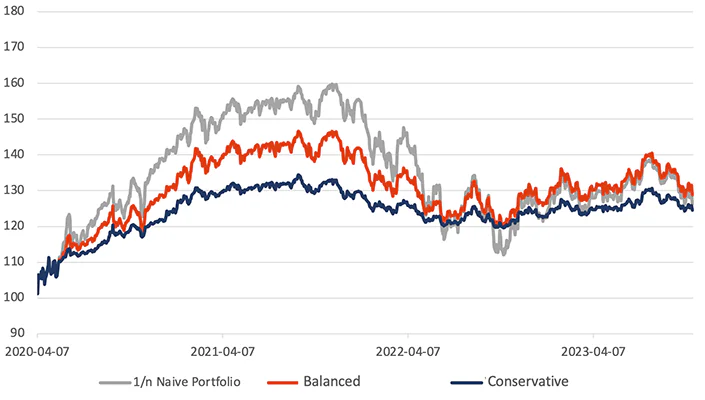

Robust Performance With Exposure Flexibility

Our strategy showcases robust financial performance, with the flexibility to tailor market exposure and volatility levels to suit varying investor risk profiles.

Customisable risk management: Incorporating volatility control levels that suit different investor preferences

1/n Historical backtest

| 1/n portfolio | Balanced | Conservative | |

| Cumulative Return | 25.3% | 28.9% | 24.6% |

| Average Return |

7.5% | 7.9% |

6.5% |

| Volatility | 18.7% | 11.8% | 7.6% |

|---|